Get Real-Time Recommendations and Evaluation on a Devoted Forex Trading Forum

Get Real-Time Recommendations and Evaluation on a Devoted Forex Trading Forum

Blog Article

The Value of Money Exchange in Global Trade and Commerce

Money exchange functions as the backbone of international profession and business, enabling seamless purchases in between varied economies. Its impact expands beyond simple conversions, affecting pricing techniques and profit margins that are critical for companies operating internationally. As variations in currency exchange rate can present significant risks, effective money threat management becomes vital for maintaining an one-upmanship. Understanding these dynamics is vital, specifically in an increasingly interconnected market where geopolitical unpredictabilities can further make complex the landscape. What are the implications of these elements on market access and long-term organization techniques?

Duty of Currency Exchange

Money exchange plays a crucial duty in promoting international trade by making it possible for purchases between events operating in different currencies. As services progressively take part in global markets, the demand for reliable currency exchange systems becomes paramount. Exchange rates, which change based on various economic indications, establish the value of one currency family member to another, influencing profession dynamics significantly.

Furthermore, money exchange reduces threats related to foreign transactions by providing hedging choices that secure against unfavorable currency movements. This monetary tool permits companies to stabilize their expenses and earnings, even more advertising global trade. In summary, the duty of currency exchange is central to the performance of global business, giving the important framework for cross-border purchases and sustaining financial development worldwide.

Influence On Prices Approaches

The mechanisms of money exchange substantially influence prices methods for organizations engaged in global trade. When a residential currency reinforces versus foreign currencies, imported products may end up being less costly, allowing services to reduced prices or increase market competition.

Moreover, organizations should take into consideration the financial problems of their target markets. Local buying power, rising cost of living prices, and currency stability can dictate just how items are valued abroad. Companies often take on rates strategies such as localization, where prices are customized per market based on money variations and regional economic aspects. In addition, vibrant rates designs may be employed to reply to real-time currency movements, guaranteeing that businesses continue to be active and affordable.

Influence on Earnings Margins

If the worth of that currency decreases relative to the company's home currency, the revenues realized from sales can reduce dramatically. Alternatively, if the foreign money values, profit margins can boost, boosting the overall economic performance of the company.

Furthermore, companies importing Get More Information goods face comparable risks. A decline in the value of their home currency can lead to greater expenses for international goods, consequently squeezing earnings margins. This scenario necessitates reliable currency danger monitoring strategies, such as hedging, to mitigate prospective losses.

Companies should remain watchful in keeping track of currency trends and adjusting their financial techniques accordingly to shield their bottom line. In recap, understanding and managing the influence of currency exchange on revenue margins is essential for companies striving to preserve profitability in the complicated landscape of international trade.

Market Access and Competition

Navigating the intricacies of international profession calls for companies not only to manage revenue margins but additionally to make certain reliable market access and improve competition. Money exchange plays a crucial role in this context, as it straight influences a company's capacity to get in brand-new markets and contend on a global scale.

A beneficial currency exchange rate can reduce the expense of exporting goods, making products more appealing to foreign customers. Alternatively, an unfavorable rate can pump up prices, preventing market infiltration. Companies need to strategically handle currency variations to maximize rates techniques and continue to be affordable versus local and worldwide gamers.

Moreover, organizations that successfully utilize money exchange can develop chances for diversification in markets click this site with desirable problems. By establishing a solid existence in several money, businesses can reduce threats related to dependence on a single market. forex trading forum. This multi-currency strategy not only improves competitiveness yet additionally promotes resilience when faced with economic shifts

Dangers and Difficulties in Exchange

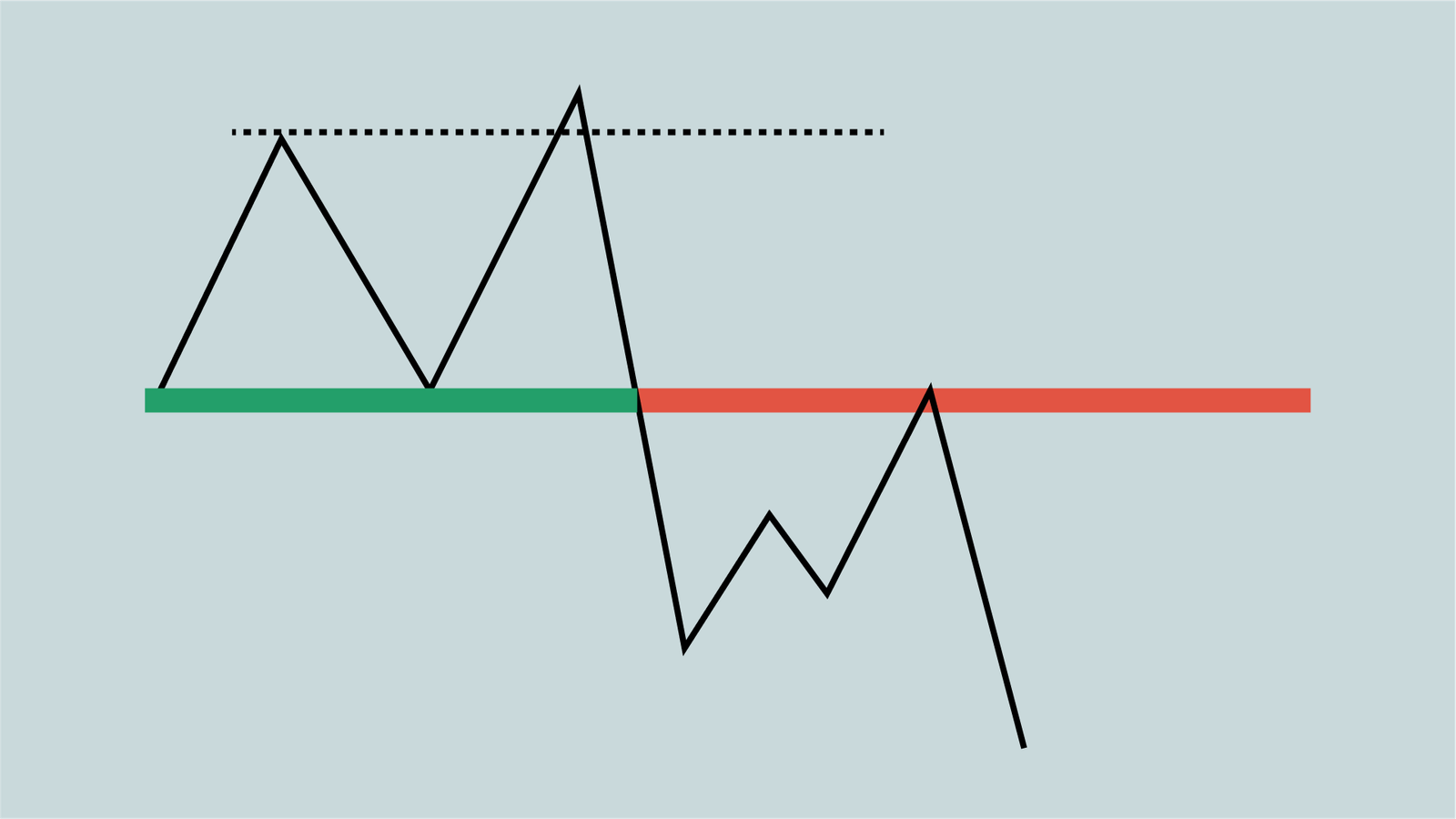

In the realm of international trade, organizations face considerable threats and difficulties connected with currency exchange that can impact their economic security and operational click to read more methods. Among the main dangers is exchange rate volatility, which can result in unanticipated losses when transforming money. Fluctuations in currency exchange rate can affect revenue margins, particularly for companies participated in import and export activities.

Additionally, geopolitical factors, such as political instability and regulatory modifications, can worsen currency risks. These aspects might result in abrupt shifts in currency worths, making complex financial forecasting and preparation. Organizations need to navigate the complexities of international exchange markets, which can be influenced by macroeconomic indications and market view.

Verdict

In verdict, money exchange offers as a cornerstone of global profession and commerce, facilitating deals and enhancing market liquidity. In spite of fundamental dangers and obstacles associated with rising and fall exchange prices, the significance of money exchange in promoting financial development and durability remains undeniable.

Report this page